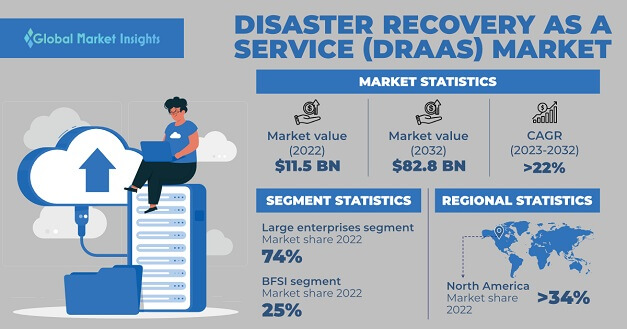

1. Market Analysis of Disaster Recovery as a Service (DRaaS)

The Disaster Recovery as a Service (DRaaS) market is expected to register a Compound Annual Growth Rate (CAGR) of 12.32% during the forecast period. DRaaS is commonly used by organizations facing events that require rapid recovery capabilities. Concerns about time to value and continuous care and feeding are essential considerations. The services often include:

- On-demand cloud recovery for testing, exercising, and planned declaration.

- Server and production data image replication to the cloud.

- Automatic failover and failback between the production environment and the target cloud.

- Service Level Agreement (SLA) negotiation.

Initially, DRaaS solutions were significantly deployed by small businesses without secondary websites or those eliminating data centers to reduce costs. However, larger organizations are also favoring DRaaS in the modern context due to reported increases in large, complex environments and server volumes per guest. Market drivers include the growing threat of data breaches and ransomware attacks, creating a demand for robust data protection solutions and cost-effective operations compared to traditional solutions.

Market players are expected to enhance market capture and reduce customer friction by providing advanced integrated options and additional capabilities to support various recovery goals, supported platforms (beyond VMware and x86 physical), international support, and enhancing DRaaS solutions with integrated additional utilities such as automated recovery testing and change management assurance.

The DRaaS market includes various players with different capabilities to meet requirements. They may relate to different workload types, geographical regions, scales, deployments, continuous support levels, Recovery Point Objective (RPO) and Recovery Time Objective (RTO) options, and target recovery locations. Providers may offer self-service, supported, or fully managed recovery services.

On the other hand, customers may need to be aware of what they have in their data centers. They must be aware of their different IT assets and how critical they are translated into the levels of service provided by DRaaS providers. The provider’s replication methods often offer different recovery stages at different price points. The lowest tier may provide the ability to recover workloads in seconds or minutes. In contrast, the middle tier may provide a recovery time for business workloads from 4 to 8 hours, and the least expensive tier may offer recovery times from 24 to 48 hours.

Global lockdowns during the pandemic have highlighted the importance of data security, with employees increasingly working remotely. The dependence on digital measures has been brought to light by several data breaches and an increase in cyberattacks. Moreover, ransomware attacks have significantly increased during the pandemic, emphasizing the need for disaster recovery solutions to prevent downtime that could lead to severe losses for organizations.

2. BFSI Sector Driving the Market

The BFSI industry has significantly adopted DRaaS solutions as financial organizations, such as commercial banks and credit unions, build their reputation around providing consistent and uninterrupted customer services. Any downtime of systems could tarnish this reputation and potentially lead to customer loss. Utilizing DRaaS solutions can provide instant recovery capabilities for data, applications, and systems.

Key sectors like banking are expected to increasingly adopt cloud-based deployment. This is because the IT industry continues to seek optimized infrastructure and the ability of solution providers to source application components and infrastructure from multiple vendors to build a hybrid cloud solution, thereby enhancing the researched market’s growth.

Most cloud recovery providers dedicated to financial organizations will scrutinize and upgrade their cloud infrastructure to meet compliance, audit, and financial industry standards. These regulatory changes benefit smaller organizations that require more resources to commit staff time to meet compliance criteria.

To secure their IT processes and systems, safeguard customer data, and comply with government regulations, both private and public organizations are increasingly focusing on deploying new technologies to prevent cyberattacks. Additionally, with larger customer expectations, increasing technological capabilities, and legal requirements, banks are being driven to adopt a proactive approach to security.

Some of the most common malware attacks that the banking industry faces include signature-less, file-less malware that operates differently from other malicious programs, leveraging root processes to hide their activities.

3. North America Expected to Experience the Fastest Growth

The United States is one of the largest markets for global DRaaS solutions. The country has been an early adopter of digital transformation strategies that have made end-users more susceptible to cyberattacks, creating a demand for secure storage and recovery. Notable players in the market include IBM, Recovery Point, Sungard Availability Services, and more.

With the increasing number of data breaches in the country, both the public and private sectors are inclined to spend more on network solutions to investigate and counter these attacks. The recent budget in the U.S. has allocated 10.9 billion USD for cybersecurity initiatives.

End-users in the region are focusing on the recovery capabilities of organizations and minimizing downtime. Businesses of all sizes are looking for ways beyond traditional methods to implement disaster recovery.

Many data breach incidents are concentrated throughout the United States. According to a survey by the Identity Theft Resource Center, the U.S. recorded 817 data breach incidents in the first half of last year. During the same period, over 53 million individuals were affected by data compromises, including data breaches, data exposures, and data leaks.

The government in the region is implementing initiatives to support the deployment of DRaaS. For instance, in October last year, FEMA approved over 357 million USD in federal disaster aid for more than 191,508 individuals and households to help kick-start recovery.

4. Overview of the Disaster Recovery as a Service (DRaaS) Industry

The DRaaS market is highly competitive and includes several major players. However, large companies like iLand Internet Solutions, Microsoft Corporation, Recovery Point Systems, Evolve IP LLC, TierPoint LLC, and IBM Corporation have introduced innovations in security and data storage systems. These companies have strengthened their market presence by ensuring new partnership relationships and tapping into emerging markets.

In June 2022, IBM Cloud Pak for Data 4.5 introduced new capabilities and features to help organizations connect with their data and drive intelligent business outcomes. IBM Cloud Pak for Data 4.5 includes uninterrupted backup and disaster recovery capabilities.

In May 2022, FalconStor Software, Inc., a reliable data protection software provider modernizing disaster recovery and backup operations for the hybrid cloud world, announced a new strategic partnership with IBM Corporation to deliver jointly validated solutions for IBM Power Systems. The solutions are designed to support enterprise customers and managed service providers (MSPs) with cloud migration and cloud backup support.

5. Disaster Recovery as a Service (DRaaS) Market News

In November 2022, CyberFortress, a managed data backup built to prevent business disruption through rapid recovery services, announced the company’s 24×7 direct support for all backup and recovery products and services. The company offers a comprehensive solution and service suite, including Managed DRaaS provided by Veeam.

In February 2022, Otava, a leading global provider of custom cloud solutions and compliance, announced that VMware had validated its cloud-based Disaster Recovery solution. Otava’s Disaster Recovery as a Service, powered by VMware, was certified by VMware as a recognized solution to help customers manage data protection concerns for on-premises and cloud infrastructures. Otava’s DRaaS protects customers’ valuable assets by providing a tightly integrated DRaaS solution specifically designed for VMware environments.

In February 2022, Global Data Vault, a provider of DRaaS, Backup as a Service (BaaS), and advanced data security solutions, was acquired by MSP Dataprise. This collaboration leads to a comprehensive portfolio of integrated data protection and cybersecurity

6. Segments of the Disaster Recovery as a Service (DRaaS) Industry

The DRaaS market caters to the recovery of enterprise applications at an alternate location in case of a disaster. The provider can offer services as fully managed, supporting recovery, or self-serving.

The agility of disaster recovery in the cloud provides businesses with a diverse geographical location for implementing backup and running as normally as possible after a disruptive event.

The DRaaS market is segmented by Industry verticals (BFSI, IT, Government, and Healthcare) and Geography (North America, Europe, Asia-Pacific).

Market size and forecasts are provided in terms of value (million USD) for all segments above.

Cre: mordorintelligence

Discussion about this post