Housing society insurance policy can get the structure of your building insured in case of unforeseen perils. Each homeowner of the housing society gets individual coverage and this coverage is provided based on the built-up area and construction cost. On behalf of the flat owner, the whole apartment can be covered only by the residents’ association. If the coverage offered is not adequate, then the association is responsible for the increase.

Companies Offering Housing Society Insurance in India

There are various companies which offer housing society insurance in India. Some of the insurance companies that provide the top plans are ICICI Lombard, Tata AIG, HDFC Ergo, Bajaj Allianz, Future Genrali and Digit Insurance. These companies offer one-touch insurance solution that covers you and your society from various perils such as earthquake, property damage, riot, burglary etc.

Inclusions of Housing Society Insurance Policy

Housing society covers the losses and damages caused to your housing society due to the fire incident. It also offers coverage for the damage or loss caused due to Lightning Explosion / Implosion. In case of any aircraft damage, this policy covers the losses incurred. Man-made calamities such as riot strike and malicious damage are covered under this plan. In addition to this, damages caused due to missile testing operations are also covered. Impact damage due to railroad vehicle or animal not belonging to insured, subsidence and landslide including rock-slide.

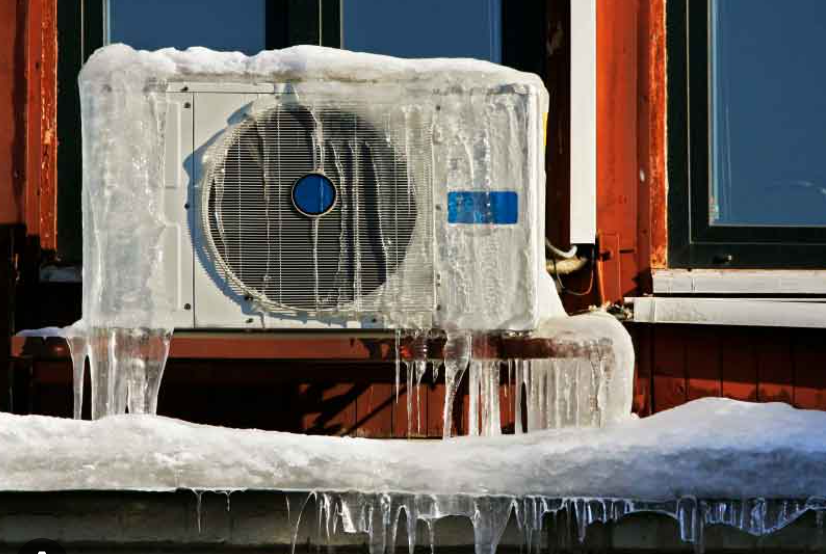

This plan comes with an extra layer of shield to help protect the insured for their possessions against natural calamities such as storm, cyclone, tempest hurricane, typhoon, tornado, flood and inundation. Also, the plan offers coverage against accidental damage – Leakage from automatic sprinkler installations and bush fire, bursting and/or overflowing of water tanks apparatus and pipes. Terrorism optional cover offers coverage against acts of terrorism for a nominal premium

Benefits of Housing Society Insurance Policy

Some of the common benefits of the Housing Society Insurance policy include:

- Coverage to all contents (covered under standard fire & special perils)

- Coverage for burglary or housebreaking (theft following upon an actual forcible, violent entry of or exit from the premises), or robbery.

- It covers loss of money which includes banknotes, currency notes/coins, bank drafts, money orders, cheques, postal orders, treasury notes, and revenue stamps) belonging to the business of the insured whilst securely kept in the insured premises.

- Offers coverage to loss or damage to any safe, strong room or cash box securing money.

- Covers you for your liability under the Workmen’s Compensation Act’ 1923 and /or Fatal Accidents Act’1855 and/or Common law to pay compensation to employees for bodily injury or death caused due to accidents / occupational diseases arising out of and in course of employment.

- Offers protection against your legal liability in respect of accidental bodily injury to third parties and or accidental loss and /or damage to property belonging to third parties.

- Provides coverage for any sudden fire incident that might cause severe damage to the amenities of your building which includes a gym, play courts, etc. Opting for an optimum housing society insurance plan will help you to get all of these areas covered under one plan.

Exclusions of Housing Society Insurance Policy

There are certain policy provisions in any insurance policy that eliminates the coverage for some risk types. These are termed as “exclusions”. Some of the common exclusions of housing society insurance policy are listed below:

- There are certain consequential losses that are uncovered under this plan.

- Few standard fire and special peril are also not uncovered under this plan. Those include loss or damage caused by war or warlike operations, the destruction caused due to ionizing radiations, contaminations caused by the hazardous radioactive, nuclear fuels or waste, pollution or contaminations losses, losses of earnings or fall of the market.

- The housing society insurance plan covers completed constructed buildings. Any building which is under construction or not under possession is not a part of the coverage of this plan.

- This plan also does not cover the cost of the land

- Also, if there is any kind of damage caused to your property willfully that is out of your policy’s scope then it not covered under this plan.

- In addition to this, any loss, damage or destruction caused due to fire or explosions, inmates or member of the insured’s household or business staff is not covered in this plan.

- Any kind of loss of money, destruction or damage caused by collusion by any employee or agent of the Insured, use of keys or duplicate keys, use of counterfeit money is excluded from the coverage of this plan.

In addition to the above exclusions, liability arising out of willful or intentional non-compliance of any statutory provision, fines, penalties, punitive and/or exemplary damages does not come under the plan

Compare Housing Society Insurance from Different Companies

It is very important to compare the housing society insurance plans online from different insurers before buying one, as it will help you to figure out the optimum plan as per your needs or expectations. There are various ways of finding the best pick which includes insurance broker’s website, web aggregator’s website, online insurance company’s website etc. On comparing different policies online, the policy seeker gets the necessary details about the plan such as benefits, features etc. which later makes the task of selecting the plan much easier for you. Moreover, you get a detailed and comprehensive data about all the plans in one go without even spending time on visiting the website of different insurance companies through the broker or aggregator’s website.

Discussion about this post