So, you’re on the exciting journey of buying a home, and you’ve come across the term “mortgage pre-approval process.” But what exactly does it entail? As someone who enjoys making complicated things simple, let’s dive into this process together and uncover its ins and outs.

Think of mortgage pre-approval as your golden ticket to the home-buying world. It’s like getting a thumbs-up from a financial wizard that says, “Hey, you’re ready to take on homeownership!”

So, what’s the fuss all about? The mortgage pre-approval process is like a financial checkup. Lenders examine your financial health, peek at your credit score, and analyze your income and debts. They want to ensure you can handle the financial responsibility of a mortgage.

Why does this matter? Well, pre-approval gives you an edge in the home-buying game. When sellers see that you’re pre-approved, they know you’re a serious contender. It’s like showing up to a race with your sneakers on, ready to sprint.

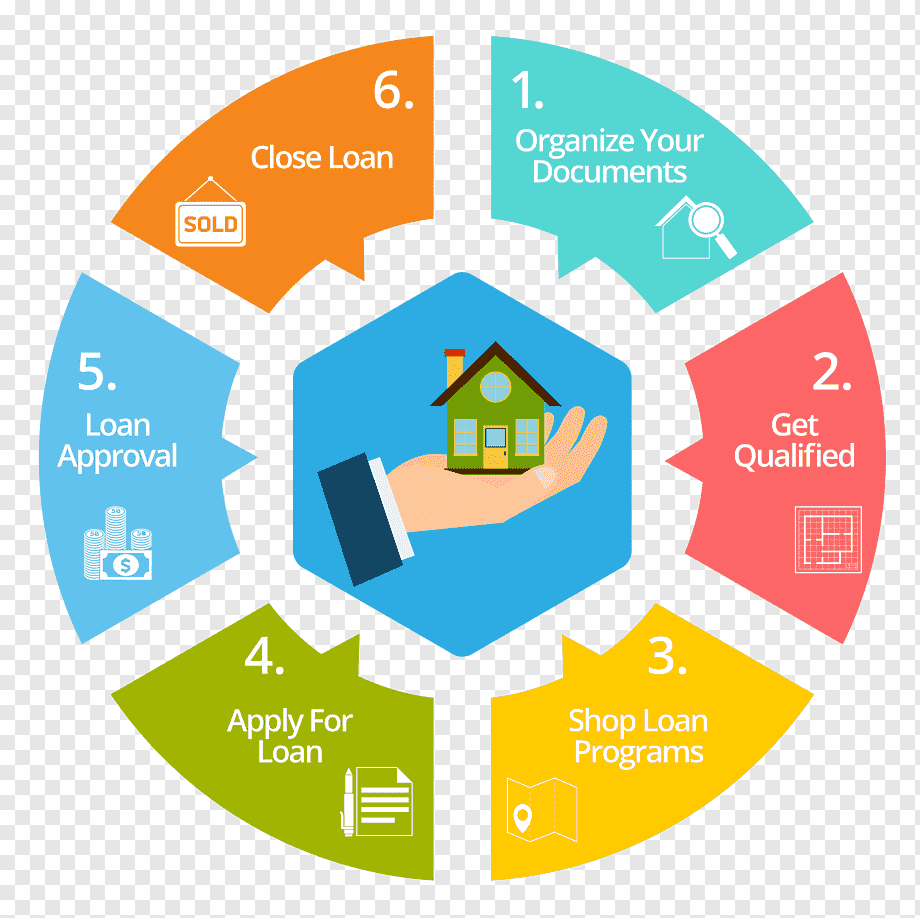

Now, how does it work? You’ll share some financial info with the lender, like pay stubs, bank statements, and tax records. They’ll crunch the numbers and come up with an amount they’re willing to lend you. It’s like finding out how big your shopping budget is before hitting the mall.

Remember, though, pre-approval isn’t a guarantee. It’s more like a good-faith estimate. The final approval comes when you’ve found your dream home, and the lender checks everything one more time.

And guess what? The mortgage pre-approval process isn’t just for buyers. If you’re refinancing, it can give you a clear picture of your budget too. It’s like planning a financial makeover for your home loan.

In a nutshell, the mortgage pre-approval process is your roadmap to homebuying success. It’s like having a financial GPS that guides you toward your dream home while helping you avoid any bumps along the way.

Getting Ahead with Mortgage Pre-Approval: A Closer Look

So, you’re diving into the world of home buying, and you’ve stumbled upon the term “mortgage pre-approval process.” But what’s the deal? As someone who likes to break down complicated things into bite-sized pieces, let’s explore this process and make it crystal clear.

Imagine mortgage pre-approval as your backstage pass to homeownership. It’s like a thumbs-up from a financial expert that says, “You’re ready to join the homeowners’ club!”

But why all the fuss? The mortgage pre-approval process is like a financial checkup. Lenders peek into your financial health, check your credit score, and scrutinize your income and debts. They want to make sure you’re financially fit for a mortgage.

Why does it matter? Pre-approval gives you an edge in the home-buying race. When sellers see that you’re pre-approved, they know you mean business. It’s like showing up at a marathon in your running shoes – you’re ready to hit the ground running.

How does it work? You spill the beans on your financial life to the lender – stuff like pay stubs, bank statements, and tax returns. They crunch the numbers and figure out how much they’re willing to lend you. It’s like handing you a budget for your home shopping spree.

But hold up – pre-approval isn’t a golden ticket. It’s more like a promise ring. The real deal happens when you’ve found your dream home, and the lender gives your financials a final check.

And guess what? The mortgage pre-approval process isn’t just for buyers. If you’re thinking of refinancing, it’s like a financial health check for your home loan.

In a nutshell, the mortgage pre-approval process is your compass in the world of home buying. It’s like having a financial guide who leads you to your dream home while helping you sidestep any financial potholes.

Discussion about this post